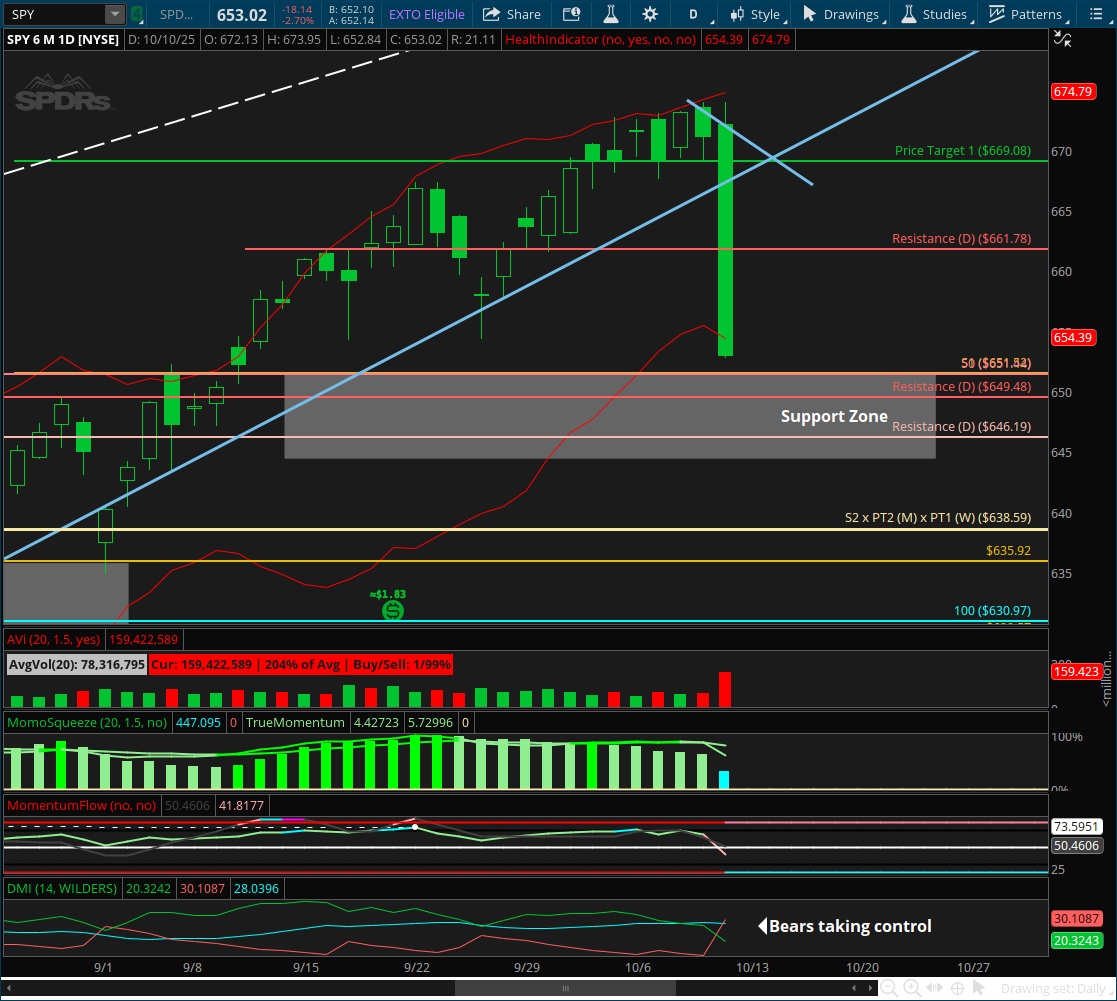

SPY Breaks the Trendline — Reversal or Regime Change?

Oct 11, 2025

SPY Breaks the Trendline — Reversal or Regime Change?

Markets don’t move in straight lines — even strong ones eventually need to exhale.

After grinding higher for weeks, SPY finally broke trendline support on Friday in a sharp, high-volume selloff that started at the upper Bollinger Band and ended below the lower. RSI dropped under 50, DMI flipped bearish, and MACD crossed down — the kind of technical shift that forces traders to pause and reassess.

But make no mistake — this is not a confirmed reversal of the long-term trend.

In fact, it’s exactly the kind of momentum reset that often precedes high-quality opportunities.

Here’s how the path forward breaks down:

1️⃣ The Optimistic Case: Buyers step back in early this week, reclaiming broken resistance and resetting momentum for another grind higher.

2️⃣ The Base Case: The market chops inside support while oversold readings unwind. A controlled consolidation phase forms at the top of the weekly pattern before the next breakout attempt.

3️⃣ The Bearish Case: Price fails to recover Monday and extends Friday’s momentum lower, creating a deeper pullback toward the broader weekly bull flag support near 613 — the prior all-time high zone.

Even in the wake of Friday’s hit, the broader structure remains intact:

-

The 50 > 100 > 200 moving average alignment still holds,

-

The daily MACD average remains above zero, and

-

The weekly MACD is in its strongest bullish posture yet.

That mix — overreaction inside a strong structural trend — is what produces reversal opportunities across leading names.

These are not breakdown conditions. They’re ignition setups in disguise — where traders who understand structure and momentum find their edge.

This week is about patience, not prediction.

Let price reveal the plan — and be ready when the structure confirms it.

👉 Learn the Ignition Point Trading Strategy and access full weekly analysis, watchlist, and trade setups at Momentum-Options.com

Learn The Strategy

Learn the exact momentum strategy that simplifies structure, timing, and trade execution—so you can trade with clarity in under 30 minutes a day.

📩 Want to Receive the Weekly Market Analysis Every Sunday?

Stay ahead of the trends with expert insights, key levels, and trade opportunities for the week ahead.

We hate SPAM. We will never sell your information, for any reason.