SPY Coiling Inside a Daily Squeeze — The Next Break Will Set the Tone

Oct 19, 2025

SPY Coiling Inside a Daily Squeeze — The Next Break Will Set the Tone

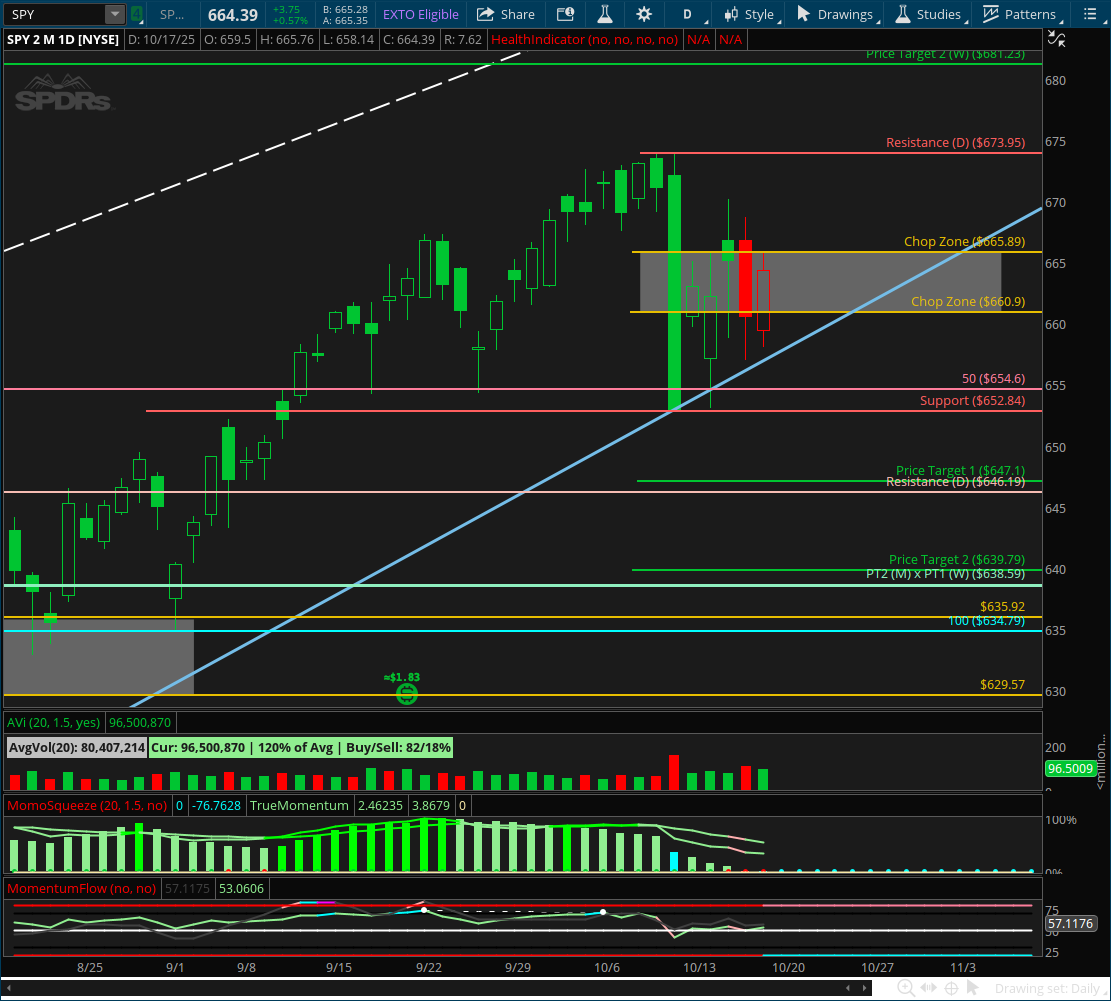

SPY spent last week grinding inside a tight range after reclaiming resistance and tagging the 669 area midweek. The move completed a new bear flag pattern inside the larger weekly bull flag — and that structure remains intact unless price closes decisively above 665.89.

Right now, the index sits in a well-defined chop zone between 665.89 and 660.90, with a daily squeeze building and momentum compressing beneath the surface.

Here’s what matters most from here:

-

The bear flag is still intact, but a close above 665.89 would invalidate it.

-

A breakout through 673.95 would confirm continuation toward the weekly target near 681.23, especially if the squeeze histogram rolls positive and MACD confirms with a crossover.

-

Traders can also watch the 4H oscillators for early confirmation — if 4H MFI pushes into overbought before MACD crosses, that often signals a failed initial breakout and the start of a new bull flag formation.

-

-

On the downside, watch for the squeeze histogram to continue expanding negatively and RSI to roll back under 50.

-

A close below 652.84 would break the short-term trend again and likely bring a pullback to the 647–639region — the same zone where buyers stepped in on previous shakeouts.

-

Until one of those conditions resolves, SPY remains in the chop zone, and this squeeze is a coil waiting for confirmation.

Patience pays here. These are the environments where impulsive traders get chopped up — the ones who wait for structure and confirmation will be ready when the next clean move begins.

👉 Learn the Ignition Point Trading Strategy and get access to the full weekly breakdown, watchlist, and setups at Momentum-Options.com

Learn The Strategy

Learn the exact momentum strategy that simplifies structure, timing, and trade execution—so you can trade with clarity in under 30 minutes a day.

📩 Want to Receive the Weekly Market Analysis Every Sunday?

Stay ahead of the trends with expert insights, key levels, and trade opportunities for the week ahead.

We hate SPAM. We will never sell your information, for any reason.