SPY Confirms the Breakout: What’s Next and 3 Setups to Watch

Aug 24, 2025

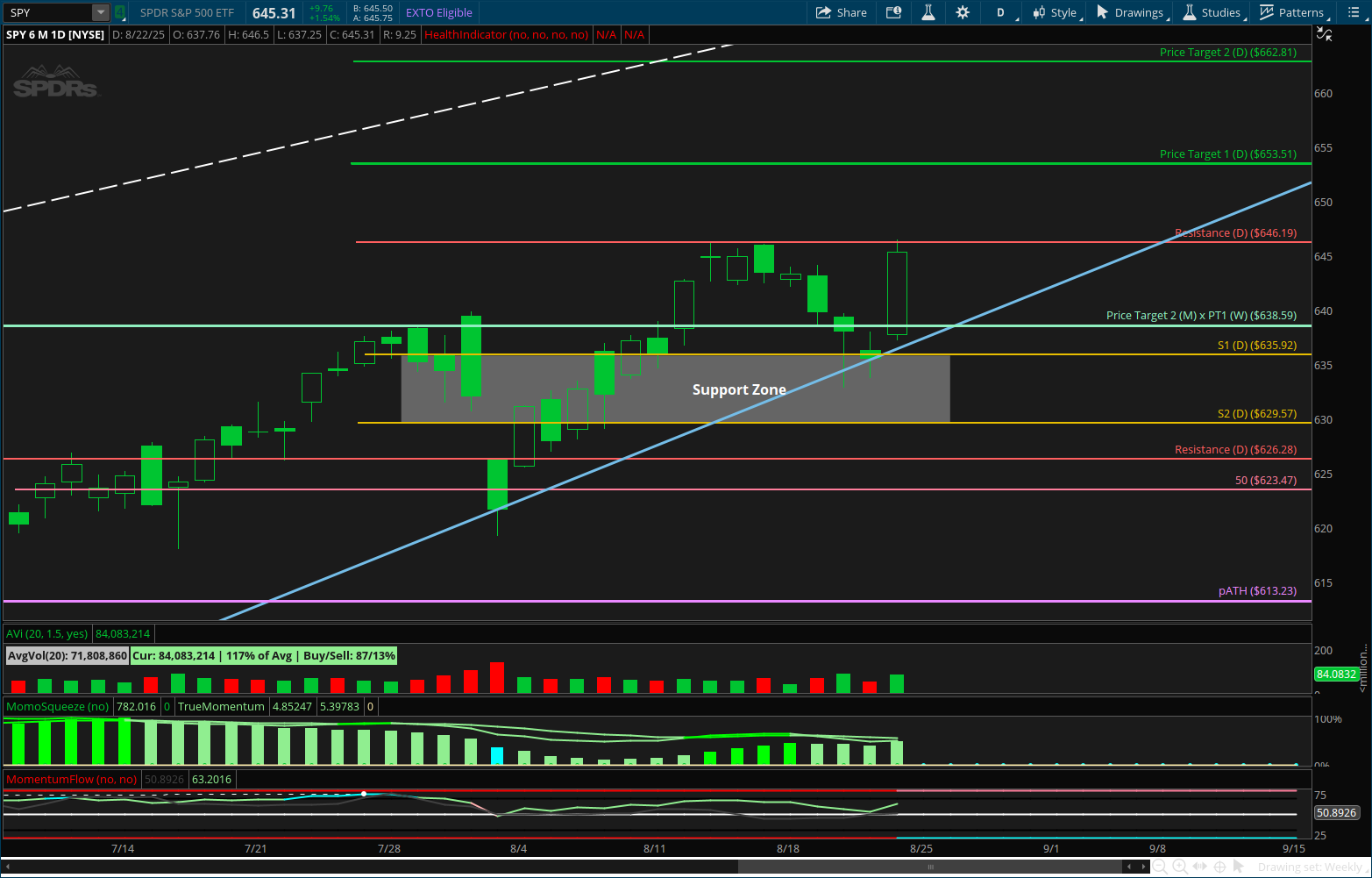

🔍 Daily SPY Analysis – Week Ending August 23, 2025

The daily chart reveals the week’s structure with much greater clarity.

As anticipated in last week’s commentary, price pulled back into the support zone, tested the rising trendline, and held. Buyers stepped in exactly where they needed to, preserving the integrity of the uptrend and setting the stage for a potential continuation.

On Friday, price began testing resistance at 646.19, though it has not yet closed above it. This is the next level to clear. If bulls can follow through with a decisive close above this resistance, the path opens toward the next fib targets at 653.51and 662.81.

📌 Key Points:

-

The support zone around 635.92 held perfectly, aligning with both horizontal structure and the uptrend line

-

Friday’s strong candle marks a shift in momentum back toward buyers

-

Squeeze momentum and TrueMomentum remain positive, but have more room to expand

-

MFI and RSI have reset from recent highs, providing room for another leg up without immediate risk of exhaustion

As long as price continues to hold the uptrend, the outlook remains bullish. This is a continuation setup in the making. A close above resistance would confirm it and likely accelerate upside toward the marked targets.

Learn The Strategy

Learn the exact momentum strategy that simplifies structure, timing, and trade execution—so you can trade with clarity in under 30 minutes a day.

📩 Want to Receive the Weekly Market Analysis Every Sunday?

Stay ahead of the trends with expert insights, key levels, and trade opportunities for the week ahead.

We hate SPAM. We will never sell your information, for any reason.