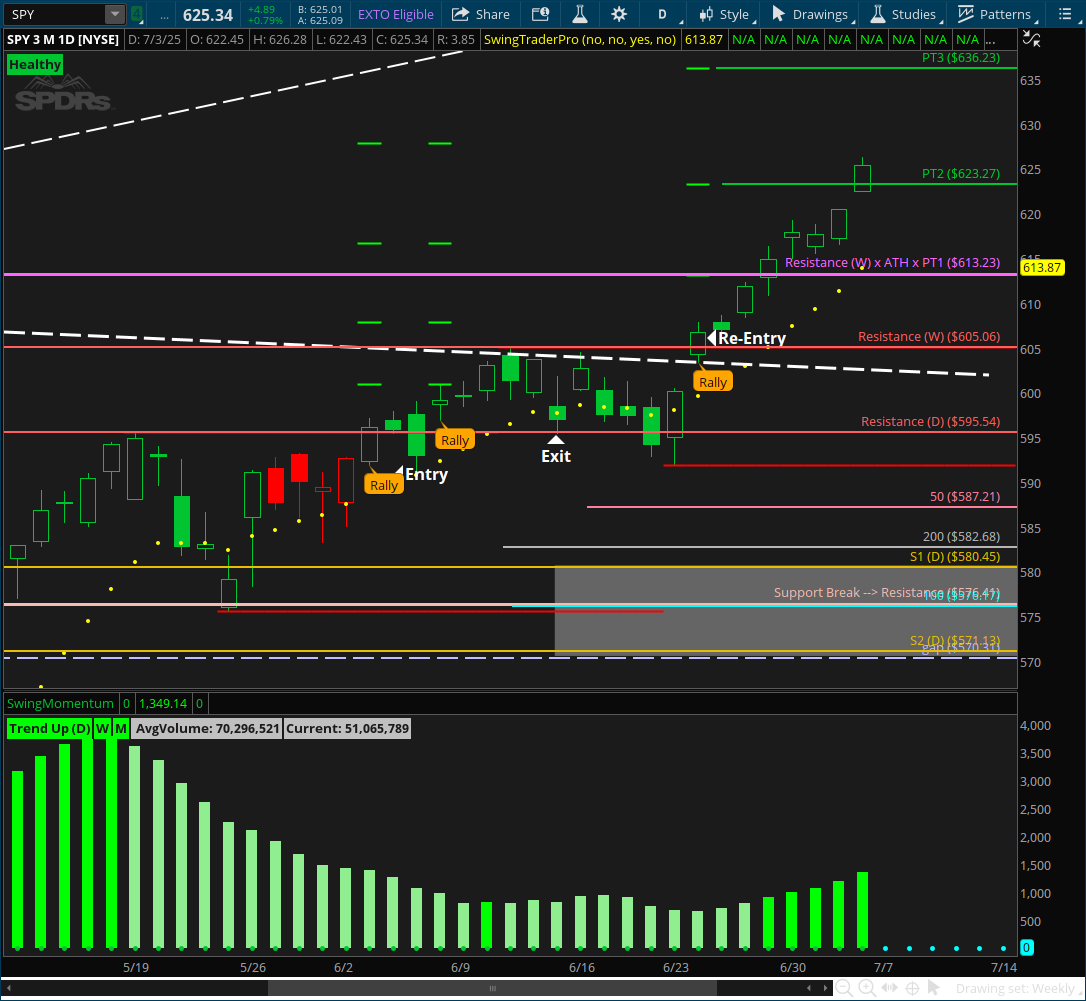

SPY Daily Overview – Week Starting July 7, 2025

Jul 06, 2025

The momentum continues to build, and the daily structure is finally catching up to confirm it.

After opening higher Monday, SPY extended its breakout, hitting the second SwingTraderPro target ahead of the shortened 4th of July holiday week. Markets opened directly at that target on Thursday, providing excellent timing for those riding the move.

More importantly, last week confirmed a key structural milestone:

-

The Golden Cross (50 SMA > 200 SMA) is complete

-

The 100 SMA is now turning higher

-

Stage 2 of the recovery trend is officially underway

Momentum is accelerating, and price continues to hold above both ATH resistance and key trend levels.

That said, with daily RSI now firmly in overbought territory, a new daily bull flag formation is becoming increasingly likely.

No cause for concern—that’s healthy price action in a strong trend. The market consolidates, resets, and offers fresh opportunity.

🔍 Daily Technical Structure

-

Price holding cleanly above trend levels and ATH resistance

-

SMA alignment improving fast, with 100 > 200 now likely next

-

SwingMomentum expanding, confirming bullish energy

-

RSI overbought, signaling potential for near-term pause or consolidation

🧠 Daily Takeaway

If you’re positioned from the breakout, stay patient—let the trend do the work.

If you’re flat, don’t chase into strength. The next best opportunity comes from structure—when a clean bull flag or consolidation pattern sets up.

This is the time to manage from strength, not emotion.

As always, focus on leaders:

-

Which tickers led this breakout?

-

Which are in very healthy alignment already?

-

Which lagged the move, still stuck in unhealthy trends?

The next setups will come from following strength, not guessing the next turn.

Let the trend play out, and be ready for the next pattern / break of structure to appear.

Learn The Strategy

Learn the exact momentum strategy that simplifies structure, timing, and trade execution—so you can trade with clarity in under 30 minutes a day.

📩 Want to Receive the Weekly Market Analysis Every Sunday?

Stay ahead of the trends with expert insights, key levels, and trade opportunities for the week ahead.

We hate SPAM. We will never sell your information, for any reason.