SPY Trend Holding, Momentum Pausing: What’s Next?

Sep 01, 2025

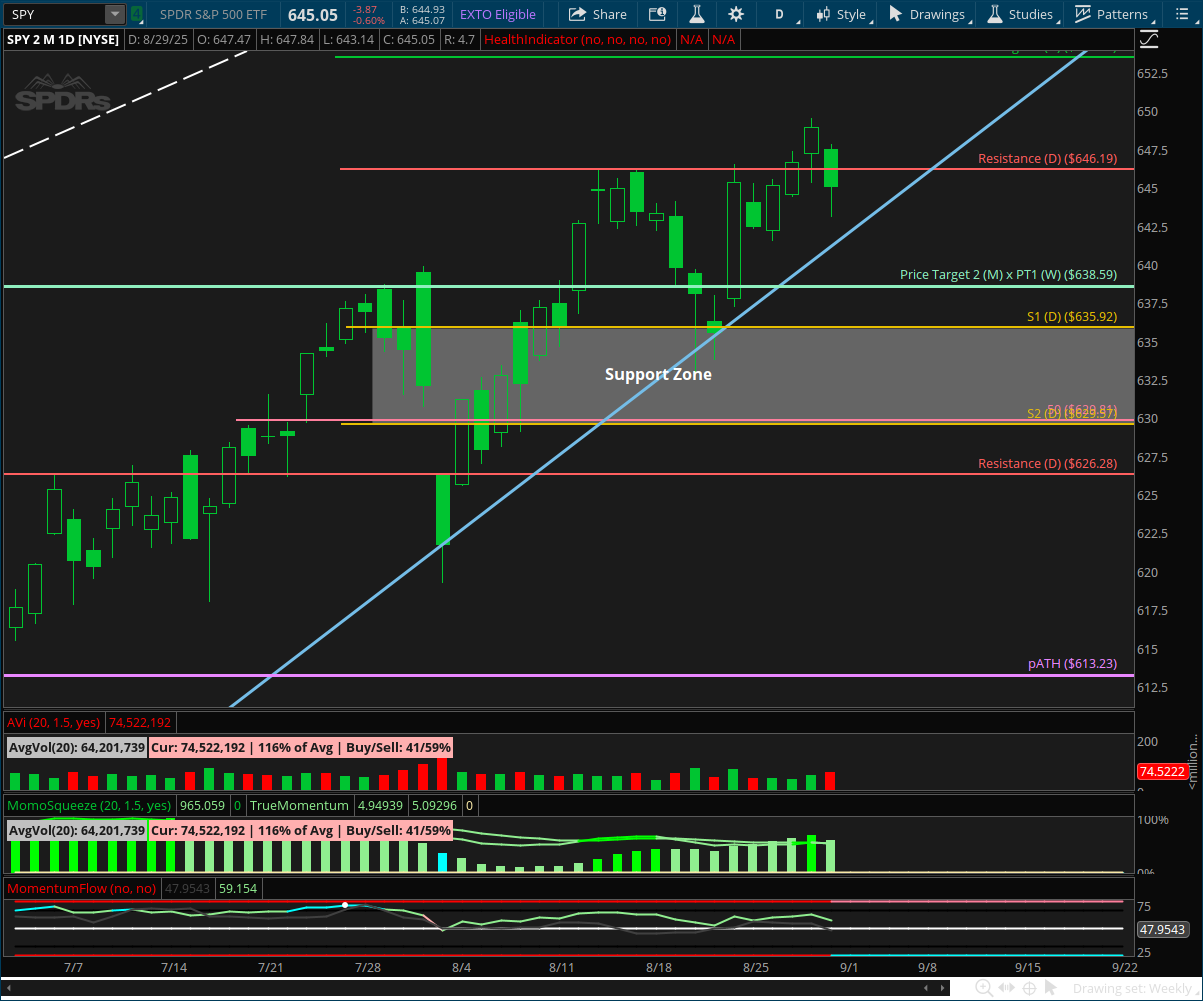

🔍 SPY Daily Analysis – Sept 2, 2025

Bulls made their move last week — but couldn’t seal the deal.

After pressing through short-term resistance on Wednesday, SPY extended the breakout into Thursday, with momentum building and the 4h MFI tagging overbought. But Friday’s weaker-than-expected data hit the brakes hard. Buyers couldn’t hold the gains, and price closed back below daily resistance at 646.19.

This puts the market in a short-term decision zone.

As long as SPY holds above the support zone between 638.59 and 635.92, the broader structure remains bullish. But failure to quickly reclaim resistance may signal the need for a deeper consolidation phase — not a breakdown, but a pause to rebuild energy and attract new buyers.

📌 What to Watch This Week:

-

A close above 646.19 would confirm continuation toward the next fib target at 653.51

-

Failure to reclaim that level quickly raises the probability of sideways action or a retest of the 50SMA

-

Momentum indicators are cooling but still in bullish alignment. No clear bear signal, just a stall

This is a classic digestion setup. The trend is still alive, but without a breakout soon, the market may need to breathe before the next move.

Learn The Strategy

Learn the exact momentum strategy that simplifies structure, timing, and trade execution—so you can trade with clarity in under 30 minutes a day.

📩 Want to Receive the Weekly Market Analysis Every Sunday?

Stay ahead of the trends with expert insights, key levels, and trade opportunities for the week ahead.

We hate SPAM. We will never sell your information, for any reason.