Weekly Market Momentum

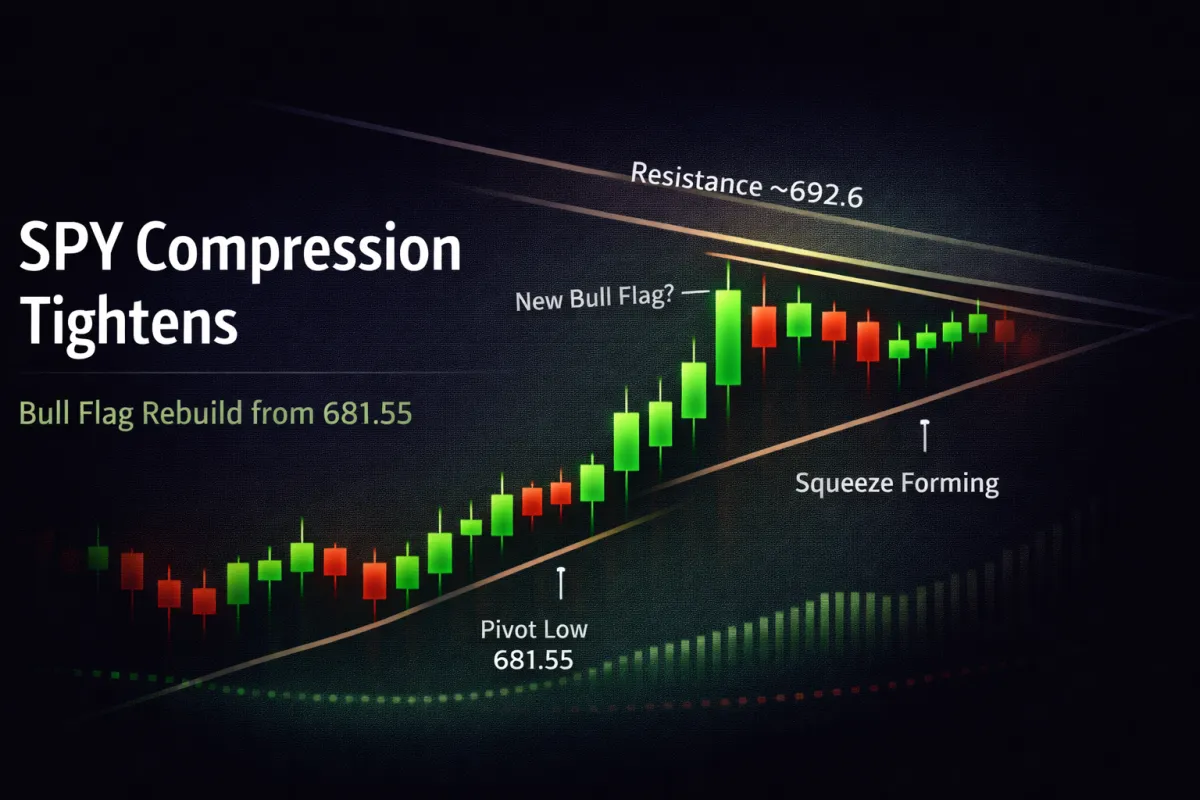

SPY Coiling Again: Bull Flag Rebuild Begins at 681.55

SPY remains trapped in multi-month compression as a new daily bull flag forms above 681.55. With weekly and daily squeezes active, momentum confirmation will determine whether price breaks toward 716.3 or rolls back into range support.

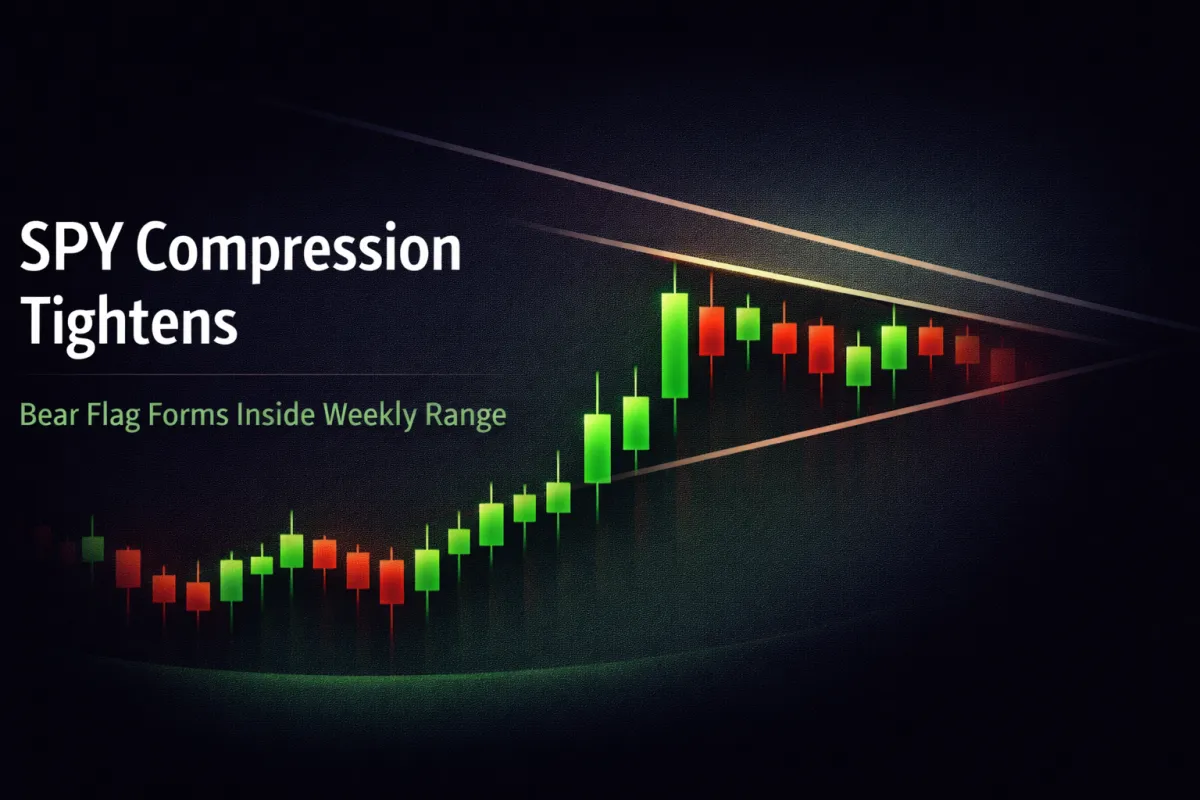

SPY Compression Tightens as Bear Flag Forms Inside Weekly Range

SPY remains trapped between 675.79 support and 692.6 resistance as a new daily bear flag forms inside a tightening weekly range. With squeeze conditions active and momentum shifting, here’s what to watch going into the week of February 16, 2026.

SPY Traps Both Sides Again — New Bull Flag Forms Inside Tight Compression

After a week of failed breakouts and breakdowns, SPY closed back above resistance, forming a potential new bull flag inside a tightening range. Momentum remains mixed — and the daily squeeze is fully loaded. Here’s what to watch this week.

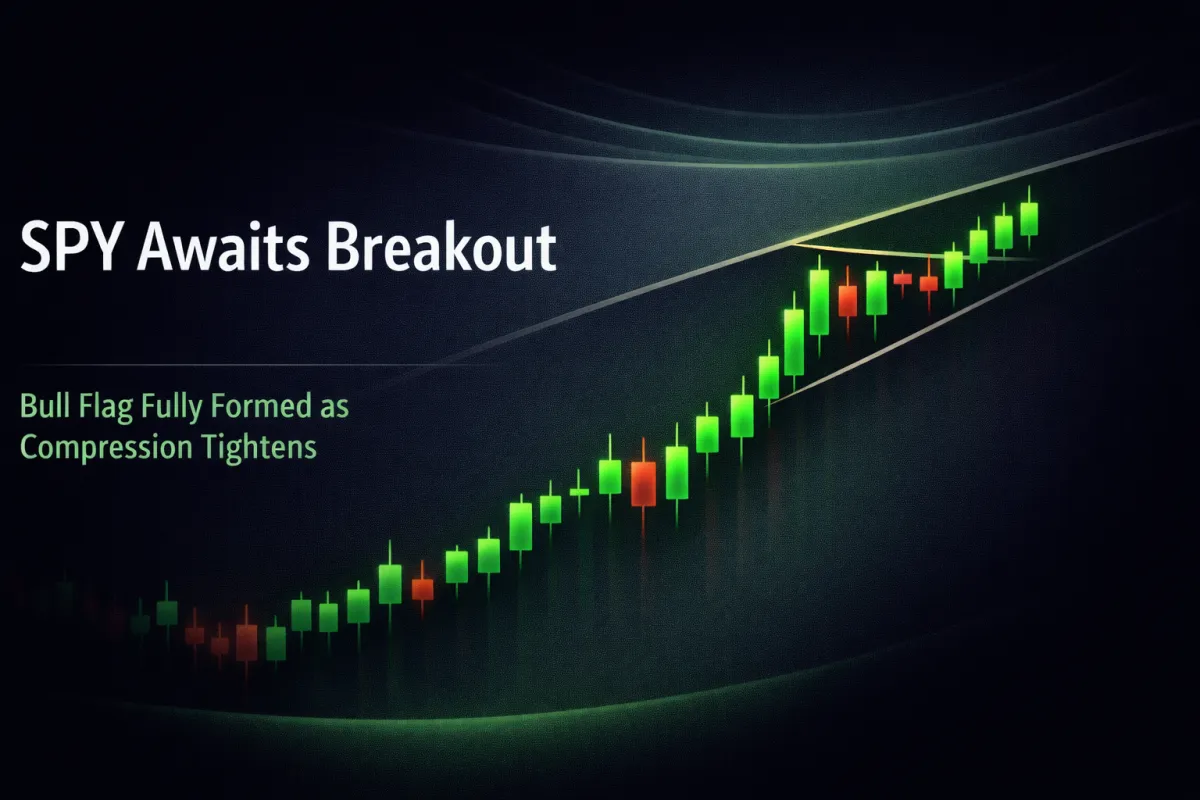

SPY Bull Flag Built — Market Awaits Breakout or Breakdown

After a volatile week, SPY has formed a clean bull flag just above key support and reclaimed weekly resistance. Price now sits in compression, awaiting a breakout or breakdown to set the next directional move. This week’s analysis covers all three timeframes — monthly, weekly, and daily — to help you stay aligned as structure tightens.